Don't see your employer listed? We work with many organizations, so reach out and have an admissions representative check what benefits may be available to you.

Have a question?

Chat with a live agent now.

Need help?

No thanks

- "City of Peoria, Arizona"

- "Lincoln Technical Institute, Inc.- HQ"

- Logan Aluminum, Inc.

- Marco's Franchising Llc.

- District 1199C Training

- 3M Company

- 7 - Eleven Inc.

- ABB Group

- ACI Learning

- Acts Retirement - Life Communities, Inc.

- American Furniture Warehouse Co. Inc.

- American Medical Response, Inc.

- AT&T Inc.

- Abbott Laboratories

- Ace Hardware Corporation

- Adtalem Global Education

- Advance Auto Parts

- Adventist Healthcare, Inc.

- Advocate Aurora Health - HQ

- Airport Authority

- Ajinomoto Health and Nutrition North America, Inc.

- Childrens Hospital Medical Center of Akron

- Albertson's Llc.

- Allegiant Travel Company

- Allegis Group, Inc.

- Allied Universal

- Allies Inc.

- Allstate Insurance

- Alorica

- Alumni Association of DeVry University and Keller Graduate School

- Amazon.com, Inc.

- American Airlines Inc.

- American West Football Conference

- Amerisourcebergen Drug Corporation

- Amphenol Corporation

- Elevance Health, Inc.

- Applied Materials Inc.

- Archer-Daniels-Midland Company

- Judco Management Inc.

- Arrow Senior Living

- Ascension Health

- Asplundh Tree Expert, Llc.

- Associa

- Asurion Corporation

- Athene USA Corporation

- Atlantic Health System, Inc.

- Augusta Health

- Autozone, Inc.

- Avita Health System

- BAE Systems, Inc.

- BASF Corporation (US)

- Best Western International Incorporated Offices

- Bahamas Institute for Business and Technology

- Bank of NY

- Banner Health

- Beacon Health

- Benesyst, Inc.

- Best Buy Enterprise Services Inc.

- Big Y Foods Inc.

- Biogen, Inc.

- BlueCross BlueShield of Tennessee, Inc.

- Boeing Company

- Bosch

- Boyd Gaming Corporation

- Brinker International

- CDW Llc.

- CNG Holdings, Inc.

- CSX Corporation

- CVS Health Corporation

- Aliv Bahamas

- Camden County Regional Chamber of Commerce

- Canon Information Technology Services

- Cantex Continuing Care Network Llc.

- Capital Blue Cross

- Cardinal Health, Inc.

- Career Services Resource Center

- Caribbean

- Carter's, Inc.

- Caterpillar, Inc.

- Catholic Health Initiatives

- Cencora

- Centene Corporation

- Cota

- Centrinex

- Charter Communications, Inc.

- Chartwells

- Chesterfield County Government

- Chicago Housing Authority

- Chicago Transit Authority

- Chick-FIL-a, Inc.

- Children's HealthChildren's Health

- Chipotle Mexican Grill, Inc.

- Choice Hotels International

- Ciena

- Cigna Corporation

- Cintas Corporation

- Cisco Systems

- City of Durham

- City of Elgin

- City of Glenn Heights

- City of Hope

- City of Houston

- City of Memphis, TN

- City of Mesa

- City of Miami

- City of Miramar

- City of Ocala

- City of Ontario

- City of Philadelphia, PA

- City of Pittsburgh

- City of Riverside

- City of Rockford

- Claire's Inc.

- Cleveland Clinic Foundation

- Colorado Springs Utilities

- Comcast Corporation

- Community Health Systems, Inc.

- Community Healthcare System

- Compass Group USA Investments Llp.

- Compliance Solutions

- Conduent Incorporated

- Consumers Energy Corporation

- Cook County Sheriff Department Partner Page

- Corestream

- Paychex Flex

- CorestreamGold

- CorestreamSilver

- County of Durham, NC

- Cox Automotive

- Cracker Barrel Old Country Store

- Dallas Area Rapid Transit

- DC Government (DCHR)

- DHL Express

- DTE Energy Company

- Daimler Truck North America Llc.

- Dallas College

- Darden Restaurants, Inc.

- DaVita Inc.

- DeVry's Transfer Advantange60 Pledge

- Delaware Dept of Health and Social Services

- Delta Air Lines

- Denver Regional Council of Governments (DRCOG)

- Destined for Greatness

- Devon Energy Corporation

- Dish Network

- Dollar General Corporation

- Dollar Tree Inc.

- Domino's Pizza Llc.

- Dover Corporation

- DriveTime Car Sales Company, Llc.

- Duly Health and Care

- Eastern Florida State College

- Ellis Medicine

- Empire Today Llc.

- Employer Partner Finder

- Envision Healthcare

- Envoy Air Inc.

- The Estee Lauder Companies Inc.

- Exelon

- Express Services, Inc.

- FIS

- Farmers Group, Inc.

- FedEx Corporation

- FedEx Ground

- Federal Energy Regulatory Commission

- Finish Line, Inc.

- FirstGroup America Inc.

- Fiserv, Inc.

- Foot Locker Inc.

- Fort Bend County

- Foundever

- Fresenius Medical Care Holdings, Inc.

- Full Potential Solutions

- GE HealthCare

- GHIMA

- GNC Corporation

- GSRG

- GXO Logistics

- Garmin International, Inc.

- General Electric Company

- General Motors

- Genesis HealthCare

- Gilead Sciences, Inc.

- GlobalFoundries

- Golden 1 Credit Union

- Google Inc.

- Government Employees Benefit Association

- Bank of America, National Association

- GrubHub

- HCA Holdings, Inc.

- HCR Manor Care Inc.

- HCSO

- H. E. Butt Grocery Company

- US Department of Health and Human Services

- Hackensack Meridian Health

- Hallmark Cards Inc.

- Hallmark Cards Inc.

- Hertz

- Highmark Inc.

- Holiday Inn Club Vacations, Incorporated

- Hollandamerica

- Honeywell International

- HonorHealth

- Hewlett Packard Enterprise Company

- H&R Block

- Huddle House

- Humana Inc.

- Hunterdon Health

- Huntington National Bank

- Hyatt Hotels Corporation

- HY - VEE, Inc.

- International Business Machines Corporation (IBM)

- Infrastructure Engineering

- IGDA

- Iam Beautiful Too Ministry

- IKEA Holding US, Inc.

- Indiana University Health

- Infocision

- Instacart

- Interactive College of Technology

- J.C. Penney Company

- J.P. Morgan Chase and Co.

- Jack in the Box

- Jason's Deli

- JIM Ellis Automotive Group

- Johnson Controls, Inc.

- Keap

- Kaiser Foundation Health Plans

- Kellanova

- Kelly Services Inc.

- Kelsey-Seybold

- Kentucky Community & Technical College System

- Kindred Healthcare

- Knox Community Hospital

- Kraft Heinz Company

- Kroger Co.

- LD Management-HQ

- Lakeland Regional Health

- Lawrence Livermore National Security, Llc.

- Learnet Academy

- Leidos Holdings, Inc.

- Lending Solutions Inc.

- Liberty Mutual Group Inc.

- The Lincoln Electric Company

- Lithia Motors

- Lockheed Martin Corporation

- Long Beach Chamber Of Commerce

- Lowe's Companies, Inc.

- Lumen Technologies Inc.

- MARTA

- Maricopa County Community College District

- MGM Resorts International

- MVISD

- Metropolitan Water District of Southern California

- Macy's Inc. and Bloomingdale's Associates

- Marion County

- Marriott International

- Massage Envy

- Maximus, Inc

- McKesson Corporation

- MedStar Health

- Meijer Companies, Ltd.

- Merck and Co., Inc.

- Methodist Healthcare System of San Antonio, Ltd., L.L.P.

- Miami - Dade County

- Micro Center, Inc

- Microchip Technology Incorporated

- Microsoft Corporation

- Microsoft Training Academy

- Molina Healthcare

- MultiCare Health Systems

- NAAAHR

- NABA

- NCCI Holdings, Inc.

- NCOA

- NGAOK

- NGASC

- NPC Restaurant Holdings

- National Women's Soccer League (NWSL)

- New York City Health and Hospitals Corporation

- New York City Police Department

- National Black MBA Association

- National Guard Association of Florida

- National Safety Council - HQ

- Nationwide Mutual Insurance Company

- NetJets Inc.

- New York City Department of Correction

- Nissan North America, Inc.

- North Jersey Chamber

- NorthShore

- Northeast Independent School District

- Northern Trust Corp

- Northrop Grumman Corporation

- Northwestern Medicine

- OhioHealth Corporation

- Olympic Steel, Inc.

- Oracle Corporation

- Orange County Transportation Authority

- OrthoSynetics

- Phoenix Children's Hospital

- Pacific Gas and Electric Company

- Palace Entertainment

- Panera, Llc.

- Papa John's International, Inc.

- Paragon

- Paychex

- University of Pennsylvania Health System

- Penn Mutual

- Pepsico, Inc.

- Perkins

- PetSmart Inc.

- Philadelphia Housing Authority

- Philips

- Piada

- Piedmont Healthcare

- American Customer Care, Inc.

- Prisma Health

- Providence Health and Services

- Pyramid Global Hospitality

- Quest Diagnostics Incorporated

- RCSO

- R.R. Donnelley & Sons Company

- Raytheon (RTX)

- Regional Management Corporation

- Remote Year

- Resilience

- Revature

- Rite Aid Corporation

- Riverside Healthcare

- Robert Half International

- Rush University Medical Center

- SCI Funeral and Cemetery Purchasing Cooperative, Inc.

- Southeastern Pennsylvania Transportation Authority

- SJVC

- Smart Global Holdings, Inc.

- SOCAP International

- SSM Health Care Corporation

- Safeguard Properties

- Safelite

- Salesforce

- Salisbury-Rowan Community Action Agency

- Salt River Project

- Save-Mart Supermarkets

- Schlumberger Limited

- Securitas Security Services North America

- Sentara Health

- Sheetz

- Shelby County Government

- Wawa, Inc.

- Sinai Chicago

- Smithfield Foods

- Southern Company

- Southwest Airlines

- State Farm Mutual Automobile Insurance Company

- State of Colorado

- Stefanini Inc.

- Study.com

- Subway Restaurants

- Sutter Health Sacramento Valley

- Synchrony Financial

- T-Mobile USA Inc.

- Telus International USA

- Takeda Pharmaceuticals

- Target Corporation

- Taylor Morrison, Inc

- Teleperformance USA

- The Adecco Group

- City of Detroit

- The Coca-Cola Company

- The Home Depot Inc.

- The University of Chicago Medicine

- The Walt Disney Company

- The GEO Group Inc.

- Thomas Jefferson Health

- Toshiba America Business Solutions

- Toshiba Global Commerce Solutions

- Toyota Motor North America, Inc.

- Tractor Supply Company

- TransUnion Llc.

- Transform Co

- Trinity Health

- Tucson Medical Center

- Tuition.io

- Tuition Manager

- Tyson Foods, Inc.

- U - Haul Holding Company

- U.S. Bank National Association

- UPMC

- United Parcel Service

- United Services Automobile Association (USAA)

- Usopc

- United States Postal Service

- Uber Technologies

- Ulta Salon, Cosmetics and Fragrance, Inc.

- UniSource Energy Services

- United Airlines

- United Negro College Fund

- United HealthCare Services, Inc.

- UnityPoint Health

- University Health

- University Hospitals Health System, Inc.

- The University of Vermont Health Network

- Utah Peace Officers Association

- Varian Medical Systems

- Verizon Communications

- Vibra Healthcare

- Wake County of North Carolina

- Wakefern Food Corp.

- Walgreens Family of Companies

- Walmart Stores, Inc.

- Waste Management

- Wawa, Inc.

- Wellspan Health

- WellStar Health System, Inc

- Wells Fargo

- Willingboro Township

- Wright-Patt Credit Union

- WHR Operations, Llc.

- Wynn Resorts

- XPO Enterprise Services, Llc.

- Xerox Corporation

- YMCA of Delaware

- YMCA of Metropolitan Washington

- YUM! Brands, Inc.

- Your Employer

- WW. Grainger

- Hearthside Food Solutions Llc.

- Intermountain Health

- Kohl's Corporation

- McDonald's Corporation

- Merakey USA

- Mercy Health

- Metrolink

- Phase Family Center

- The Progressive Corporation

- triOS

- TTECTTEC Holdings

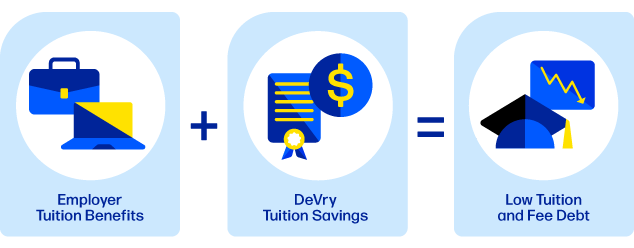

Looking to save on your tuition and fees?

Organizations offer tuition benefits as a way to invest in their employees. Tuition benefits can provide you with equitable learning opportunities, optimize costs for corporate learning, and the opportunity to gain new skills. Continual learning can be beneficial to stay ahead of potential changes in your field and open opportunities for career growth.

Tuition benefits vary from organization to organization, but the most common are tuition reimbursement or tuition assistance.

Tuition reimbursement is a benefit provided by employers after you have provided proof of successful completion of coursework. You would pay for your coursework upfront and then submit the cost to your employer for reimbursement.

Tuition assistance is a benefit provided by employers where your employer pays DeVry University directly on your behalf.

The amount of tuition benefits offered by organizations varies, but some may offer at least $5,250 per employee per year.* It is important to check with your organization to determine the amount available to you.

According to the Internal Revenue Service, “if you receive educational assistance benefits from your employer under an educational assistance program, you can exclude up to $5,250 of those benefits each year. This means your employer shouldn’t include those benefits with your wages, tips, and other compensation shown in box 1 of your Form W-2. This also means that you don’t have to include the benefits on your income tax return.”*

Direct billing is a practice in which an organization pays DeVry University directly instead of reimbursing an employee. This can help streamline the process of tuition payment and avoid situations where an employee would have to pay tuition upfront.

While tuition benefits vary depending on your organization, the policy might require that you maintain a certain grade or GPA.

All organizations are different, some will cover some or all levels of academic programming, such as certificates, associates, bachelors and masters. Some organizations require that your field of study or coursework be relevant to your job. Coverage will vary and depend on your employer’s policies.

Retention requirements vary depending on the organization, but generally, some policies will require that you remain with the organization for a certain period of time after completing a program.

Organizations can require that employees maintain a satisfactory job performance in order to qualify for tuition benefits.

*Tax Benefits for Education, Internal Revenue Service (January 2023)